Can the World Build AI Infrastructure Fast Enough Without Running Out of Clean Power?

Inside: Global bottlenecks, investor strategies, and why the next AI hub might not be where you expect.

Welcome to Global Data Center Hub. Join 1200+ investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The Energy Gap That Could Derail the AI Boom, Everywhere

AI isn’t just transforming business. It’s straining the world’s energy systems.

From Lagos to London, Jakarta to Northern Virginia, data centers are growing faster than the grids that power them. And while billions are being spent on chips, land, and fiber, a quieter constraint is threatening to stall progress:

There’s not enough clean energy near where we’re building AI infrastructure.

This is no longer just a U.S. or Europe issue. It’s becoming a global bottleneck and one that’s forcing investors to rethink where they deploy capital, how they model returns, and which regions might quietly become the next digital infrastructure superpowers.

The Global Energy Strain Behind AI’s Growth

Global data center energy use is expected to exceed 1,000 terawatt-hours annually by 2026.

AI workloads are driving a 160% increase in energy demand within 24 months.

In top markets like Northern Virginia, data center power demand is projected to quadruple by 2035.

But in Mumbai, São Paulo, and Johannesburg, new data center builds are already hitting grid limits before permits are even secured.

The result?

A global mismatch between where compute wants to grow and where clean, scalable power actually exists.

Transmission Bottlenecks and Regulatory Delays Are Everywhere

Whether in the U.S. or emerging markets, one pattern keeps repeating:

2.6 terawatts of renewable energy is stuck in interconnection queues globally.

Transmission buildouts can take 4–10+ years, depending on region.

Power procurement is increasingly tangled with political, regulatory, and ESG constraints.

In parts of Africa, developers must choose between diesel backup or delays bringing power to the site. In Europe, data center projects are paused due to ESG zoning restrictions. In India, transmission timelines can become a gating factor, even as renewables accelerate.

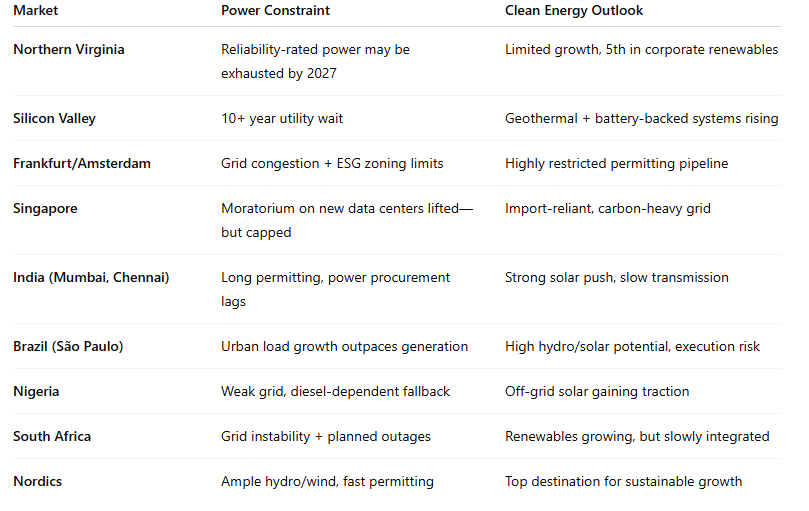

Global Power Constraint Snapshot

The pattern is clear: power isn’t just a “cost input”, it’s the new investment filter.

The Financial Impact of Clean Power Scarcity

Delayed power means:

24–36+ month project hold-ups, even on permitted land

IRR compression from extended capital lock-up

Power-secure sites commanding 20–40% premiums globally

A growing divide between “energy-rich” regions and those stuck in planning limbo

Even for hyperscalers, clean energy availability is now a board-level constraint.

5 Global Investor Shifts We’re Seeing

To adapt, smart capital is adopting five new plays:

1. Clean Power as the First Filter, Not the Last

Before land or fiber, investors now ask:

Can we secure clean power within 36 months?

Is there PPA potential or utility partnership appetite?

What’s the regulatory pathway for renewables or grid buildout?

If the answers are weak, the project stalls, regardless of demand.

2. Power-Entitled Sites Are Premium Assets

From Jakarta to Johannesburg, smart money is prioritizing:

Sites with existing grid allocations

Projects with pre-approved energy permits

JV models bundling land, energy, and zoning into bankable packages

In some markets, these sites are 10x more investable than comparable land without power.

3. Shifting to Renewable-Rich Regions

Operators and cloud providers are prioritizing:

The Nordics (Sweden, Finland, Iceland): Low latency, high hydro

Texas / Midwest U.S.: Strong wind/solar with deregulated grids

Emerging renewables clusters: South India, Eastern Indonesia, Kenya’s geothermal belt

It’s not just latency anymore, it’s sustainability alignment and delivery speed.

4. Hybrid and Modular Energy Models

New builds are exploring:

Microgrid solutions using solar + storage

Modular nuclear pilots (e.g., Oklo, Switch, RPower)

Diesel-to-renewable transitions in Africa and Southeast Asia

These aren’t backup plans, they’re go-to-market accelerators.

5. De-risking Through Energy Partnerships

Investors are co-developing with utilities and IPPs to:

Share upfront capex

Lock in long-term PPAs

Co-locate renewables and data centers (e.g. Google + Intersect Power in Texas)

In power-constrained regions, energy security is becoming the core value proposition.

Final Take: The Next AI Hubs May Surprise You

The world isn’t short on compute demand. It’s short on clean, available power.

And that’s reshaping the map of opportunity.

Whether you're investing in Ashburn, Accra, or Ahmedabad, the question is the same:

Can this site get reliable, renewable energy, fast?

Those who ask it early will avoid delays, unlock deals others can’t touch, and shape the future of global compute.

Those who don’t?

They’ll be left stranded. By the sun, the grid, or the next political shift.

Because in this game, you don’t win by building first.

You win by powering first.