You received this email because you subscribed to Global Data Center Hub, a newsletter about the global data center sector.

Thank you very much for supporting my newsletter this month. Your readership encourages me to provide these insights, and I’m truly grateful for it.

We publish new insights seven days a week, helping you stay ahead of the most important shifts in data centers, AI infrastructure, and global connectivity.

Our premium insights are reserved for paid subscribers.

If you haven’t upgraded yet, now’s a great time:

👉 Subscribe and join hundreds of readers of “Global Data Center Hub” with a 20% discount on the annual plan: Subscribe here

The global AI race is in full swing.

But while everyone’s focused on GPUs and datacenter real estate, a quieter crisis is brewing…

Power.

In Southeast Asia, demand is soaring, but energy infrastructure may not be ready.

Operators are racing to deploy, policymakers are scrambling to modernize grids, and investors are betting billions.

In this deep dive, we unpack:

- Why AI’s power demands are reshaping SEA’s infrastructure agenda

- Where the region’s biggest grid bottlenecks lie

- What countries like Malaysia, Singapore, and Indonesia are doing to stay competitive

- The complex trade-offs between price, carbon, and sustainability

The New Appetite for Compute

Datacenters have grown from niche infrastructure into the digital backbone of the cloud era, originally driven by social media, content delivery, and infrastructure-as-a-service.

Since 2022, the rise of AI has pushed compute demand to unprecedented levels. Training large models today requires exponentially more compute than pre-2020 workloads.

For example, training GPT-4 consumed approximately 62.3 GWh of electricity over 100 days, comparable to the annual energy usage of about 5,800 average U.S. homes (or ~15,000 Malaysian homes).

This surge in compute comes with a massive energy footprint. AI servers today draw 50+ kW per rack, compared to ~1 kW per rack for traditional enterprise workloads. As models grow in complexity, power requirements will only increase.

Datacenter Supply – The Growing Footprint

Global datacenter IT power is projected to nearly double from 49 GW in 2023 to 96 GW by 2026, with approximately 42% attributed to AI workloads, according to SemiAnalysis.

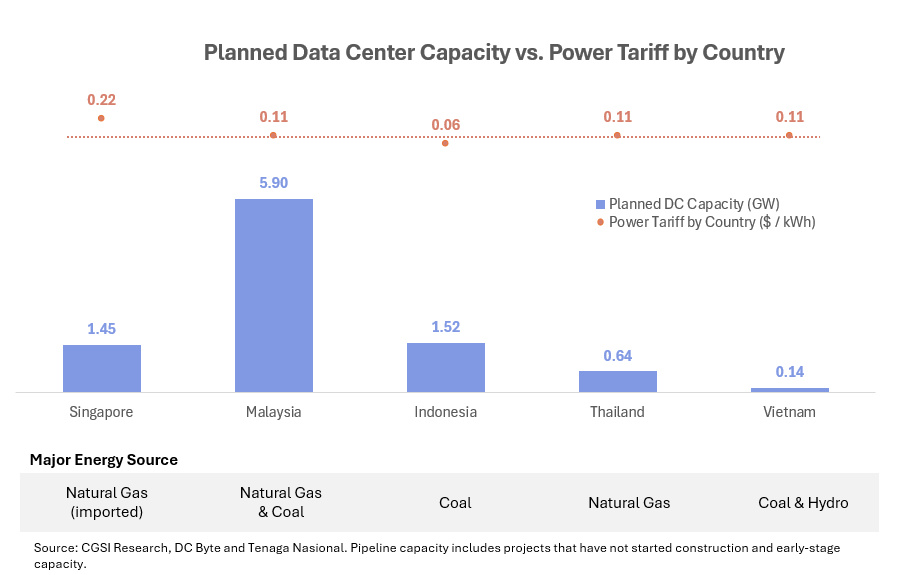

In Southeast Asia, CGSI Research and DC Byte estimate datacenter capacity will grow from 1.7 GW currently to 7.6 GW by 2028, encompassing early-stage and planned projects.

As of end of 2024, Malaysia’s state utility Tenaga has delivered 1.9 GW of IT capacity for datacenter projects, though only ~405 MW is currently utilized. The forward pipeline totals 5.9 GW.

One wildcard is the potential impact of the 2025 U.S. AI Diffusion Export Controls, particularly in Malaysia. The jury’s still out, but an early assessment suggests that a significant portion of planned capacity could be affected1.

Currently, most datacenter investment is concentrated in Singapore and Malaysia.

The former offers excellent connectivity, a business-friendly environment, and strategic location, but its land and power constraints led to a four-year moratorium on new datacenters.

Malaysia, especially Johor, has emerged as a key alternative. Key site selection factors for investors remain consistent: grid reliability, power pricing, supply chain resilience, and time to market. We discussed in our earlier post, The Race for Data Center Sites.

The Grid Gap & Hardware Crunch

Power-related system constraints are a bottleneck globally and across Southeast Asia.

The datacenter buildout has only amplified these challenges. Lead times for transformers have doubled to 2–4 years, up from 1–2 years, given their custom-built nature.

Other components (i.e. generators, switchgears, cabling, smart meters) face similar delays and mounting demand. This aligns with the region’s broader need for grid modernization. Southeast Asia’s power infrastructure lags in both robustness and flexibility.

Grid upgrades typically require 5–10 years of planning, while datacenter developers aim for deployment within 1–2 years.

This mismatch is especially stark in Malaysia, where Tenaga expects electricity demand from datacenters to exceed 5 GW by 2035, equivalent to 20% of the country’s current generation capacity.

To address this, Tenaga has announced plans to invest $7–8 billion through 2030 to upgrade national grid infrastructure. Impact on the local grids was already prevalent in Ireland and Singapore.

The Sustainability Challenge

Unlike the self-sufficient U.S., some ASEAN nations, especially Singapore, rely heavily on imported natural gas, which accounts for about 90% of Singapore’s power mix.

This dependence contributes to higher electricity tariffs ($0.22/kWh vs. $0.083 in the U.S.) which significantly increases operating costs for energy-intensive industries like datacenters.

Meanwhile, Malaysia and Indonesia offer more competitive rates (~$0.11 and $0.06/kWh, respectively), but their energy sources are more carbon-intensive.

Malaysia is a net exporter of oil and gas, while Indonesia relies heavily on coal, which emits more than twice the CO₂ per kWh compared to natural gas—further compounding environmental challenges.

To offset emissions, leading datacenter operators are turning to virtual Power Purchase Agreements (PPAs) and Renewable Energy Certificates (RECs) to reduce their carbon footprints.

These instruments enable companies to financially support renewable projects, even if the clean power isn’t consumed directly. Examples include Google, Microsoft, Equinix and Meta in Singapore, and AirTrunk’s 150 MW campus in Johor.

On a national scale, Malaysia is ramping up its efforts by planning to boost renewable generation from 10 GW to 55 GW and targeting 70% of its total energy mix by 2050. This transition is backed by MYR 637 billion (~$142 billion) in planned investment.

However, despite these ambitious targets, energy storage infrastructure across ASEAN remains underdeveloped, posing a major hurdle to delivering stable and reliable renewable energy supply.

The challenge is particularly acute for datacenters, which require continuous power to operate efficiently. Running on 100% renewables 24/7 remains out of reach, largely due to the intermittent nature of solar and wind. Bridging this gap will require scalable and cost-effective energy storage systems.

Some alternatives are being piloted, such as biofuels (used in STT's Singapore facility) and lithium-ion batteries, but their adoption is constrained by high costs and limited deployment at scale.

Large-scale battery storage projects, in particular, face both financial and technical barriers that must be addressed to support long-term grid stability.

For countries like Singapore, where local renewable generation is limited by geography, cross-border solutions are beginning to take shape.

One example is the Lao PDR–Thailand–Malaysia–Singapore Power Integration Project (LTMS-PIP), which has begun importing up to 100 MW of renewable hydropower from Laos to Singapore via existing transmission lines (in Thailand and Malaysia).

Phase Two of the project aims to double this capacity to 200 MW and enable multidirectional flows, expanding the region’s ability to share and balance clean energy resources.

What’s Next?

Innovation is pushing forward: from liquid cooling and high-efficiency chips to grid-integrated renewables and smarter load management.

But the hard truth remains:

Southeast Asia’s infrastructure is racing against time to meet AI’s demands.

And the greater challenge isn't just powering the boom, but building sustainable, resilient grid infrastructure for the decades ahead.

---

This piece is written in collaboration with Pink Sakdiarpa. Pink is a former investment banker focused on AI, digital infrastructure, and blended finance across Southeast Asia and emerging markets.

---

Sources and References

[1] SemiAnalysis’s AI Datacenter Energy Dilemma – Race for AI Datacenter Space and 2025 AI Diffusion Export Controls articles here are great sources

[2] Kenanga Research and HongLeong Research Note

[3] Industry’s note on transformer crisis

[4] ASEAN Briefing

[5] Example of renewable PPAs signed by Google, Microsoft, Equinix and Meta and AirTrunk’s 150 MW

[6] News of ST Telemedia Global Data Centers (STT GDC) adopting biofuel as a backup power

One More Thing

I publish daily on data center investing, AI infrastructure, and the trends reshaping global data center markets.

Join 900+ investors, operators, and innovators getting fresh insights every day and upgrade anytime to unlock premium research trusted by leading investors and developers.