Can Microsoft double its global data center empire by 2027?

Microsoft’s $80 billion buildout aims to double its global data center footprint by 2027 testing the limits of capital, energy, and execution in the race to power the AI economy.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

The signal: infrastructure velocity becomes strategy

During its Q1 FY2026 earnings call, CEO Satya Nadella confirmed what markets had been speculating:

“We will increase our total AI capacity by over 80% this year and roughly double our total datacenter footprint over the next two years.”

That statement reframes hyperscale competition. For the first time, infrastructure velocity how fast megawatts, land, and chips are energized has become the primary competitive metric.

Microsoft already operates 400 data centers in 70 regions. Doubling that by 2027 implies a physical network approaching 800 facilities and 4+ GW of new capacity. It’s an expansion that outpaces the grid capacity of several small nations.

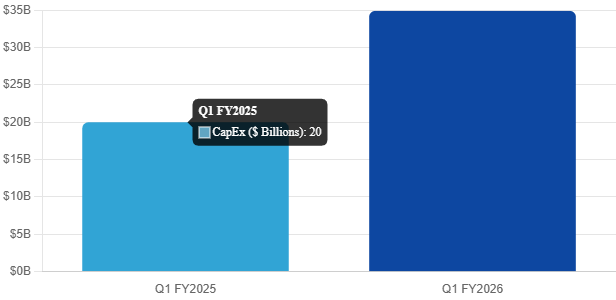

Capital flows: $34.9 billion in a single quarter

The financial numbers are staggering.

Q1 FY2026 CapEx: $34.9 billion (+74% YoY)

FY2025 commitment: ≈ $80 billion globally

Data center leases (Q1): $11.1 billion the highest in corporate history

Half of that spending went directly to GPUs and CPUs; the rest to land, construction, and energy access. CFO Amy Hood called them “short-lived assets,” yet the strategic reality is different: every GPU cluster becomes a revenue-producing asset the moment it’s energized for AI workloads.

For investors, Microsoft is no longer a pure software firm; it’s acting like a sovereign infrastructure developer with private-credit scale.

Geography of growth: the three-continent push

United States: The $7B Fairwater Campus in Wisconsin is the flagship three buildings, 1.2M sq ft, and capacity to scale to 2 GW, hosting 72 NVIDIA GPUs per rack.

Asia: New Azure regions launched in Malaysia and Indonesia in 2025, with India and Taiwan coming in 2026, each built for AI-optimized workloads.

Europe & LATAM: Regions in Austria, Chile, and Spain expand capacity near enterprises while diversifying power sources.

This mirrors capital flows to sovereign partners Malaysia’s Digital Investment Office, India’s MeitY, and Brazil’s BNDES all offering incentives for AI-ready infrastructure.

Demand engine: OpenAI and Copilot

Microsoft’s infrastructure gamble is anchored by contracted demand.

The OpenAI agreement extends through 2032, including a $250 billion compute purchase commitment and $135 billion stake.

Internal services such as Microsoft 365 Copilot and GitHub Copilot now exceed 150 million users monthly.

Each new facility effectively comes pre-booked.

For coverage bankers, this converts CapEx risk into offtake certainty, comparable to power-purchase agreements in the energy sector.

Strategic discipline: pause, re-allocate, repeat

Despite the aggressive expansion, Microsoft canceled or deferred ≈ 2 GW of leases in 2025 across the US and Europe. This wasn’t a retreat; it was portfolio optimization. Hood described the shift as building a “fungible fleet”: clusters designed for different stages of AI training and inference, distributed across energy-advantaged markets.

It’s an emerging model of capital recycling within hyperscale portfolios exit low-density sites, redeploy to AI-dense campuses with better power economics.

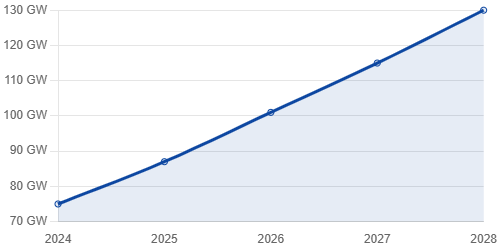

The constraint: power before profit

Even with record spending, demand still exceeds supply. Azure regions in Northern Virginia and Texas remain under capacity restrictions through mid-2026. Globally, data-center electricity demand is expected to hit 130 GW by 2028, up 16% annually.

To stay ahead, Microsoft is executing energy partnerships once reserved for utilities:

$10 billion Brookfield deal to add renewable generation.

Constellation agreement to restart an 835 MW nuclear plant in Pennsylvania.

Accelerated permitting for solar and hydro portfolios across Asia and EMEA.

The company’s 24/7 carbon-free-energy target by 2030 now doubles as a hedging mechanism against power-price volatility.

The sustainability tension

Every hyperscaler faces the same paradox: carbon goals colliding with AI demand.

Microsoft’s energy use could rise 600% by 2030. Even with zero-water cooling systems saving 125 million liters per facility per year, the net carbon impact remains under pressure.

The next phase of investor scrutiny will focus less on emissions totals and more on energy sourcing per MW of AI capacity a metric likely to appear in future ESG disclosures.

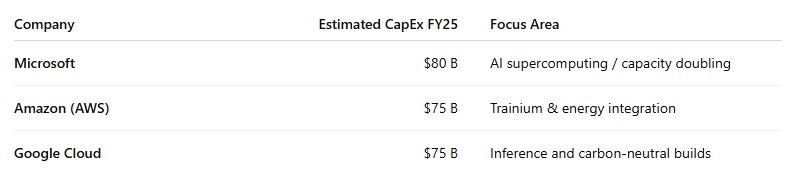

Competitive posture: hyperscale as infrastructure class

Approximate FY2025 CapEx race:

Microsoft’s differentiator isn’t just spend; it’s integration. Azure is tied to Microsoft 365, Windows, and OpenAI. That full-stack control compresses the time between capital deployment and revenue recognition.

Execution risk and resilience debt

October 2025’s Azure Front Door outage was a reminder of fragility at scale. Doubling the footprint means exponential configuration complexity.

Microsoft is automating deployment pipelines and introducing “shift-left” resilience testing to limit systemwide incidents. For investors, operational stability now ranks alongside financial leverage as a determinant of valuation.

What it means for stakeholders

Investors: Compute clusters are becoming a bankable asset class. Expect structured financings, including ABS, private credit, and lease-back deals, all anchored by AI offtake contracts.

Operators: Speed-to-power will dictate valuations. The ability to energize 100 MW ahead of schedule could add entire percentage points to return profiles.

Policymakers: Grid reform and permitting velocity now define national competitiveness. Markets like Malaysia and India demonstrate how targeted incentives can attract hyperscaler capital at scale.

The takeaway

Can Microsoft double its data center empire by 2027? Yes, if it continues converting massive CapEx into contracted compute faster than global power grids can keep up.

This is more than an expansion it’s a structural shift. Microsoft’s buildout could redefine how digital infrastructure is financed, permitted, and monetized worldwide, setting the blueprint for how capital, energy, and compute converge in the AI-driven economy.