Are Crusoe and Starcloud Creating the First Real Data Center Market in Space?

Inside the new compute geography where uninterrupted orbital solar replaces land, permits, and utility constraints.

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

AI demand has outrun terrestrial power.

Generation, transmission, and interconnection are capped, and the grid cannot expand at the speed compute is growing.

The Crusoe–Starcloud partnership is a response to that constraint.

It creates a new geography for compute one detached from land, permitting, utilities, and grid limits, shaped instead by solar exposure and the physics of vacuum.

The core idea isn’t orbital hardware. It’s relocating compute to the only environment that can scale faster than demand.

Power Constraints Driving Innovation

AI power density has outgrown the grid. A 1GW campus can host a million GPUs, but transmission takes a decade while training cycles run in weeks. Core markets are saturated, queues span years, and moratoriums stall new sites.

Crusoe saw this coming. They’ve always moved compute to surplus energy flare gas, stranded wind, curtailed renewables.

Orbit is the next step: constant solar with no intermittency or permitting.

Starcloud makes it operational through a dawn-dusk Sun-Synchronous Orbit.

Continuous sunlight, no batteries, no water, no grid. Power becomes an orbital variable rather than a regulated one.

Orbit as a New Compute Geography

A new data center market requires distinct power economics, physical constraints, and workload profiles. Crusoe–Starcloud satisfies all three.

Orbital solar is constant and ~40% stronger than peak terrestrial irradiance, driving power costs toward near-zero over time. Cooling in orbit is radiative, eliminating water and most mechanical infrastructure.

The architecture fits training, batch compute, simulations, and on-orbit imagery processing workloads where power matters more than latency.

This isn’t a replacement for terrestrial cloud; it’s a new region type and a new geography of compute.

From Demonstration to Orbital Scale

Starcloud-1’s November 2025 launch carried a single H100. Not scale, just physics validation: proving GPUs can survive orbital heat, radiation, and vacuum.

Late 2026 brings the first real deployment: Crusoe Cloud on a dedicated Starcloud satellite. Early 2027 brings commercial GPU availability the shift from experiment to product.

From 2028 onward: multi-GPU modules, multi-MW clusters, then optical-linked swarms. The endpoint: gigawatt-class orbital compute powered by kilometer-scale solar arrays.

This mirrors terrestrial hyperscale’s evolution pilot regions, modular expansion, platformization except the constraints and multipliers in orbit are fundamentally different.

Cost Dynamics Determining Viability

All orbital compute economics hinge on one variable: the cost of lifting mass to Low Earth Orbit.

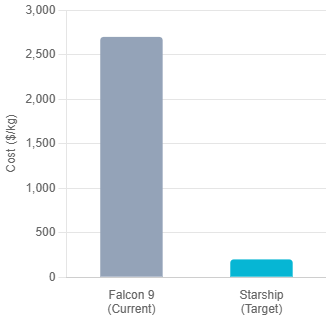

Falcon 9 is ~$2,700/kg. That doesn’t scale. Starship targets <$200/kg. If it hits that range, orbital compute becomes cheaper than terrestrial power for training workloads within a decade; if not, it stays a niche capability.

Crusoe and Starcloud are positioning ahead of that curve. Frontier markets form this way: infrastructure is built before the economics fully mature, just as hyperscale forced its cost structure into existence.

Orbital compute will follow the same pattern high initial cost, rapid learning, scale-driven declines, accelerating deployments, and early-mover lock-in.

First Commercial Use Cases

This market won’t emerge from general-purpose cloud. The first viable use cases are specific and non-substitutable.

On-orbit satellite data processing: SAR, hyperspectral, and multispectral imagery can be processed before downlink, cutting cost and congestion.

Large-scale training: if orbital power trends toward near-zero, orbit becomes the cheapest place to train frontier models.

Sovereign compute: nations with grid limits or political constraints may treat orbital regions as jurisdictionally controlled infrastructure.

Resilience: orbit is insulated from terrestrial disasters, grid failures, and geopolitics, creating a strategic continuity layer.

This market arises not by replacing terrestrial cloud, but by enabling workloads Earth’s infrastructure cannot scale to support.

Risk Profile for Investors

The risks are significant and must be priced with precision.

Radiation degradation: commercial GPUs aren’t radiation-hardened, so failure rates rise and depreciation accelerates.

Thermal limits: multi-MW or GW radiative cooling demands structures larger than anything ever flown; feasibility is still unproven.

Launch dependence: the model assumes frequent, reliable Starship launches; any interruption disrupts capacity, refresh cycles, and economics.

Regulatory uncertainty: export controls, spectrum rules, debris mitigation, and treaty constraints define the operating boundary.

SLA reality: orbital compute won’t deliver five-nines. It’s built for batch workloads, not real-time inference.

This is not terrestrial hyperscale with orbital flair. It’s a fundamentally different asset class with its own risk vectors and return profile.

Strategic Interpretation

This partnership marks a break from terrestrial limits. Compute supply is detaching from the grid, and orbit is emerging as the first viable new geography.

Crusoe and Starcloud are not launching satellites. They’re building a market created by Earth’s scarcity and space’s abundance, powered by uninterrupted solar energy.

They’re creating the first real data center market in orbit. The real shift begins when the rest of the industry recognizes orbital compute as competitive, not conceptual.