Amazon $200B AI CapEx Reset; Power Becomes the Bottleneck; Sovereign Capital Rewrites the Map

Inside the capital, power, and policy shifts redefining global AI infrastructure

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

If you’re not a subscriber, here’s what you’ve missed so far:

Where the Next Gigawatt of AI Capacity Will Actually Be Built [Inside the New Global Hierarchy Shaped by Power Availability, Policy Alignment, and Platform Capital.]

How to Invest in Data Centers (And the Risks That Actually Matter) [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

9 Reports Shaping Global Data Center Strategy — Q4 2025 Intelligence Briefing [An intelligence synthesis of the reports shaping AI-driven infrastructure, capital allocation, and market direction.]

Q4 2025: The Quarter AI Infrastructure Became State Power [How power, capital, and policy fused to redefine the global AI buildout.]

Interested in sponsorship? info@globaldatacenterhub.com

In This Issue

Global Buildout at a Glance — Hyperscalers reset capex expectations, private capital consolidates Asia-Pacific platforms, and sovereign-backed data center strategies advance across Europe, the Middle East, and Africa.

Power + Policy = Advantage — U.S. utilities signal structural load growth, Europe tests nuclear-linked data centers, and planning regimes increasingly determine where AI capacity can actually land.

Sovereign Capital Meets AI — Saudi Arabia, the UK, and Africa’s institutional investors move from enablers to owners, reshaping who controls AI-era compute.

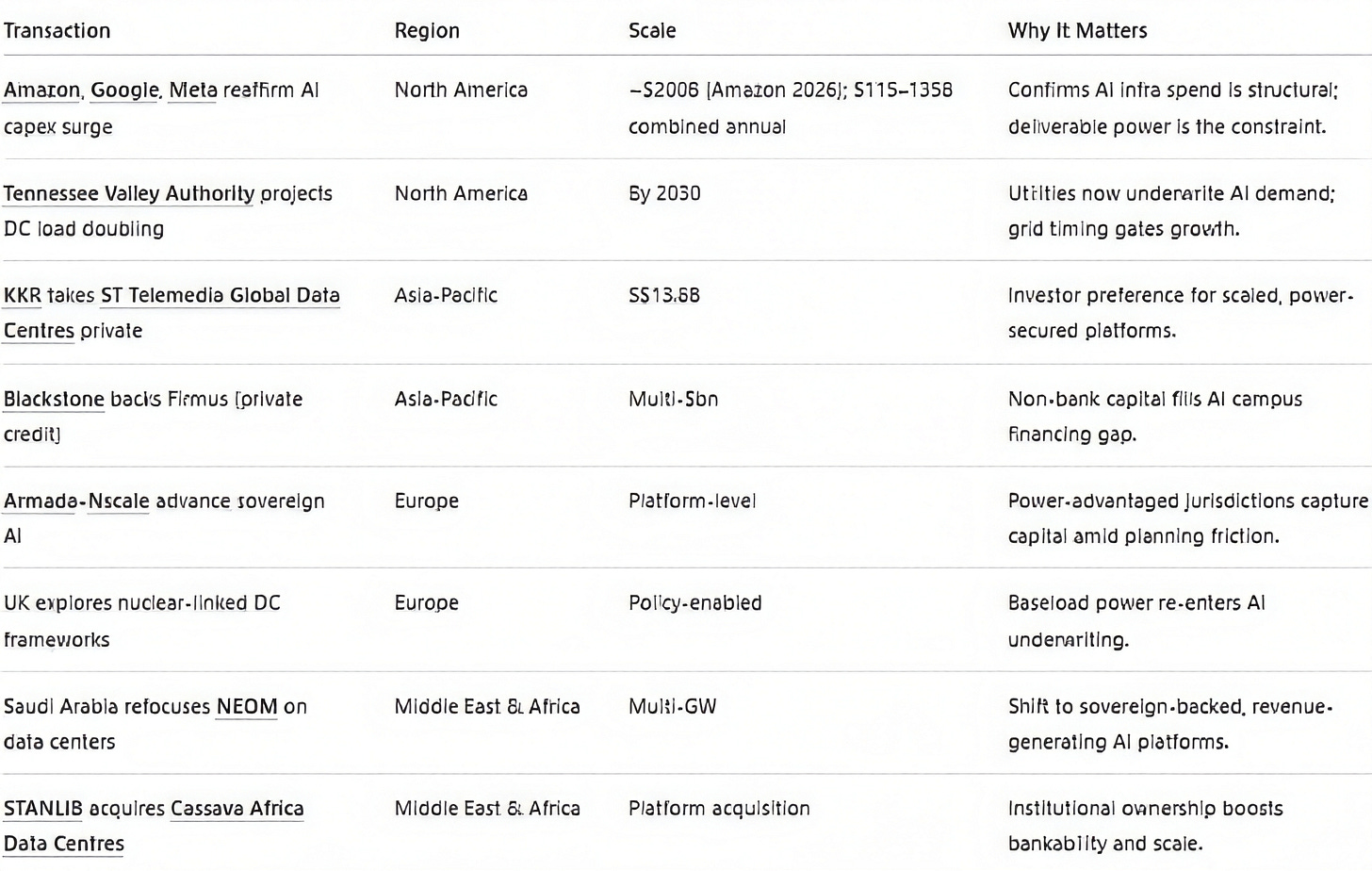

Notable Transactions — From a S$13.8B Asia-Pacific take-private to multi-billion-dollar private credit and platform financings, capital stacks continue to migrate from projects to portfolios.

Dear Friends,

A new phase of AI infrastructure is taking shape defined less by isolated data center announcements and more by programmatic capital deployment, power security, and platform scale.

This week made the shift clear. Amazon’s ~$200B 2026 capex, alongside accelerated spend from Google and Meta, is normalizing nine-figure AI infrastructure investment. Power now drives the market: U.S. utility forecasts pace hyperscale growth, APAC capital consolidates around power-secured platforms, and Europe’s sovereign AI ambitions hinge on grid access. In the Middle East & Africa, Saudi NEOM and African institutional ownership show AI compute is treated as national infrastructure, not discretionary tech.

The takeaway is unmistakable: the next decade of AI will not be won by better models alone, but by those who can control deliverable power, entitled land, and long-dated capital at scale and do so across regions.

Global Buildout at a Glance

A 1-minute scan of the week’s biggest moves — by region.

North America — Amazon’s ~$200B 2026 capex signal, alongside accelerated data-center investment by Google and Meta, reinforced a clear pattern: AI infrastructure growth is concentrating where power can be delivered at scale. Utility forecasts most notably from the Tennessee Valley Authority, projecting data-center load doubling by 2030 show that grid expansion, not capital, now paces hyperscale growth, with institutional capital consolidating around power-secured platforms.

Europe — The Armada–Nscale partnership advanced the UK’s sovereign compute agenda, but planning resistance and court scrutiny showed that AI capacity will cluster only in politically permissive, power-secure zones. At the same time, Microsoft pushed expansion into Southern Europe to escape northern congestion, while Infineon’s €500M investment signaled Europe’s parallel strategy of strengthening the AI infrastructure supply chain even as hyperscale siting remains constrained.

Asia-Pacific — KKR’s S$13.8B take-private of ST Telemedia Global Data Centres consolidated one of the region’s largest hyperscale platforms, reinforcing investor preference for repeatable, multi-country operators. In Australia, Blackstone’s multi-billion-dollar private-credit support for Firmus Technologies confirmed that AI demand is pulling forward grid, entitlement, and construction decisions at a national level, even as traditional bank finance lags.

Middle East & Africa — Saudi Arabia’s review of NEOM toward data centers reflected a broader regional shift: digital infrastructure is being prioritized as a revenue-generating anchor asset rather than a secondary component of mega-developments. In Africa, STANLIB’s approval to acquire Cassava Africa Data Centres marked a turning point, positioning local institutional capital as an owner not just financier of continental AI and cloud capacity.

Notable Transactions

Key shifts, structures, and risks across this week’s global deal tape.

This week confirmed that AI-scale growth is portfolio-driven, power-led, and institutionally financed, shifting from single-asset bets to repeatable platforms backed by firm power, utility balance sheets, and sovereign capital.

Hyperscaler signaling now drives deals. Amazon’s ~$200B 2026 capex, alongside Google and Meta, shows the constraint is deliverable megawatts, not capital or land. Utility forecasts, like TVA’s load doubling by 2030, make grid investment and interconnection timing the key gating factors. Power certainty now takes priority over real estate.

Across Asia-Pacific, platform consolidation led the market. KKR’s S$13.8B take-private of ST Telemedia Global Data Centres highlighted demand for multi-country operators with repeatable development playbooks, while Blackstone’s private-credit support for Firmus Technologies showed non-bank capital stepping in where traditional finance lags.

In Europe, power scarcity shaped deals and policy. Armada–Nscale advanced sovereign AI but planning rejections and court challenges showed that power-advantaged jurisdictions demand heavy capital. UK nuclear-linked DC discussions signal baseload power is returning to long-duration infrastructure assumptions. In the Middle East & Africa, Saudi NEOM and STANLIB’s Cassava acquisition mark a shift toward platform ownership, boosting bankability and long-term capacity.

Across South America, deal activity remained quieter but strategically important. Enterprise-led, modular deployments like recent moves in Argentina suggest the next wave of transactions will focus on localized demand, latency-sensitive workloads, and regulatory clarity, rather than hyperscale land grabs.

If you’re enjoying this newsletter, share it with a colleague.

Have a great week.

Global Data Center Hub