Alphabet Inc. Q4 2025 Earnings: The $270B Infrastructure Reset

How $175–185B in 2026 CapEx Redefines AI Leadership Around Power, Silicon, and Scale

Welcome to Global Data Center Hub. Join investors, operators, and innovators reading to stay ahead of the latest trends in the data center sector in developed and emerging markets globally.

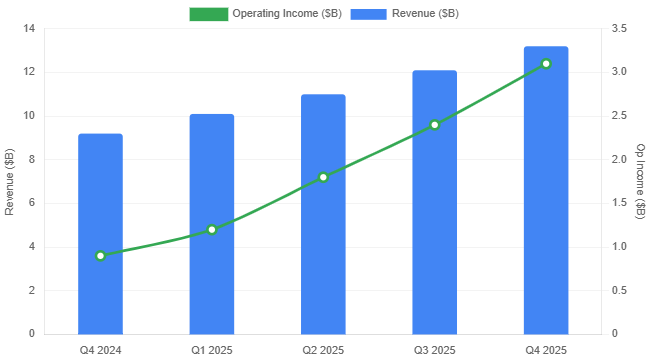

Alphabet’s Q4 was strong on the surface and strategic underneath. Revenue rose 18% YoY to $113.8B, GAAP EPS increased 31% to $2.82, and full-year revenue surpassed $400B for the first time, reaching $402.8B in 2025.

The real headline was forward-looking: 2026 CapEx guidance of $175–185B, nearly double 2025’s $91.4B and more than triple 2024’s $52.5B, positioning Alphabet among the most capital-intensive companies globally. The focus now shifts from growth durability to capital efficiency at hyperscale.

Q4 operating income rose 16% to $35.9B, though margins dipped slightly to 31.6%, partly due to a $2.1B Waymo charge. Free cash flow growth trailed earnings as infrastructure spending accelerated, with Q4 CapEx reaching $27.9B evidence the higher capital phase had already begun.

Search, YouTube, and the AI Expansion Effect

Google Services generated $95.9B in Q4 revenue, up 14%. Search & Other led with $63.1B, growing 17% YoY. AI Overviews now reach over 2 billion users, with management emphasizing that AI is expanding search activity increasing query complexity, session length, and multi-modal usage rather than cannibalizing it.

YouTube Ads rose 9% to $11.4B despite tough election comps. Total YouTube revenue, including subscriptions, surpassed $60B in 2025, while paid subscriptions across Google One and YouTube exceeded 325M, adding recurring revenue beyond ads.

Notably, revenue from generative AI-based products surged nearly 400% YoY in Q4, signaling that AI monetization is already material across both consumer and enterprise offerings.

Google Cloud: Margin Expansion at Scale

Google Cloud has become the strategic core of Alphabet’s growth. Q4 revenue reached $17.7 billion, up 48% year-over-year, materially outpacing AWS at 24% growth and Microsoft Cloud at 29%. Although smaller in absolute scale, its growth rate is structurally higher.

Profitability is scaling with revenue. Operating income more than doubled to $5.3 billion, and margins expanded to roughly 30%, up from the high teens a year earlier. Cloud is no longer subsidized growth; it is generating meaningful earnings.

Backlog ended 2025 at $240 billion, up 55% sequentially and more than double year-over-year. Management noted that billion-dollar deals signed in 2025 exceeded the prior three years combined. Annualized revenue now exceeds $70 billion, providing multi-year visibility.

AI demand is operating at production scale. Nearly 75% of Cloud customers use AI tools, with hundreds processing over 100 billion tokens monthly. First-party models are handling more than 10 billion tokens per minute via APIs, indicating sustained enterprise compute intensity.

The $175–185 Billion Infrastructure Commitment

Alphabet’s 2026 CapEx guidance is reshaping its operating model. About 60% targets servers (TPUs, GPUs, CPUs) and 40% funds data centers and networking. Following $91.4B in 2025, 2026 would push two-year spending above $270B, putting Alphabet alongside Meta and Amazon in capital intensity.

Management highlighted constraints across advanced semiconductor packaging, GPU supply, liquid cooling systems, and grid-level power. The strategy is preemptive: secure capacity before bottlenecks tighten. AI leadership is increasingly determined by control over deployable megawatts, silicon allocation, and commissioning speed.

Custom TPUs provide partial insulation from external GPU concentration, but infrastructure expansion remains capital-intensive. Alphabet is no longer scaling primarily through software. It is scaling through power, land, networking, and compute density.

Balance Sheet Strategy and Long-Duration Capital

To support this capital program, Alphabet executed a $20 billion multi-tranche bond issuance in early 2026 and issued a rare 100-year sterling-denominated bond. Investor demand materially exceeded supply. The willingness of debt markets to fund Alphabet on long-duration terms reflects its quasi-sovereign credit profile and strong operating cash generation.

This financing strategy mitigates near-term free cash flow compression while preserving liquidity and shareholder return flexibility. Alphabet maintains significant cash and marketable securities on the balance sheet and retains substantial operating cash flow capacity from Search and YouTube.

Waymo and Optionality

Other Bets generated $370 million of revenue in Q4 and reported a $3.6 billion operating loss, amplified by the Waymo compensation charge. Waymo now operates in six cities, generates approximately $10 million per week in revenue, and announced a $16 billion investment round largely funded by Alphabet.

While the segment remains loss-making, its valuation and geographic expansion indicate a transition from research initiative to scaled mobility platform. The strategic optionality is long dated but increasingly tangible.

Regulatory and Execution Risk

Regulatory overhang remains material. The U.S. Department of Justice continues to pursue structural remedies in search, including potential Chrome divestiture. European regulators are reviewing the proposed Wiz acquisition and broader AI regulatory compliance under the EU AI Act and Digital Markets Act.

Execution risk is equally significant. A $180 billion CapEx envelope requires timely data center commissioning, stable power procurement, and high utilization rates. Delays in grid interconnection or supply chain constraints could push revenue realization further into 2027–2029. Margin pressure may persist if infrastructure scales faster than monetization layers.

Strategic Conclusion: Infrastructure Defines AI Leadership

Alphabet has moved decisively from a capital-light, software-margin narrative toward a full-stack infrastructure thesis. AI is already revenue-accretive across Search and Cloud, but the 2026–2027 period will test whether Alphabet can convert backlog and token throughput into durable return on invested capital.

The company has effectively declared that AI leadership is determined by physical infrastructure control as much as algorithmic capability. If backlog conversion sustains current momentum and Cloud margins remain near 30%, the $175–185 billion programs will be viewed as pre-emptive capacity capture. If utilization lags, free cash flow volatility will dominate the narrative.

Alphabet is no longer merely monetizing information. It is financing and building the physical substrate of the AI economy.

Great breakdown. So much going on right now.